This is the formula for price elasticity of demand:

Price Elasticity of Demand = (% Change in Quantity Demanded)/(% Change in Price)

And this is how most people visualize it intuitively, regardless of whether they studied economics or not:

What this shows is a linear function, where a 5% increase in price will lead to a 5% decrease in sales volume.

And the other way around: if we decrease the price by 5%, we will sell more by 5%.

I know that you all know that it never works like this in real life.

Yet most companies and managers still make pricing decisions based on that effect as their “gut feeling”.

What is price elasticity?

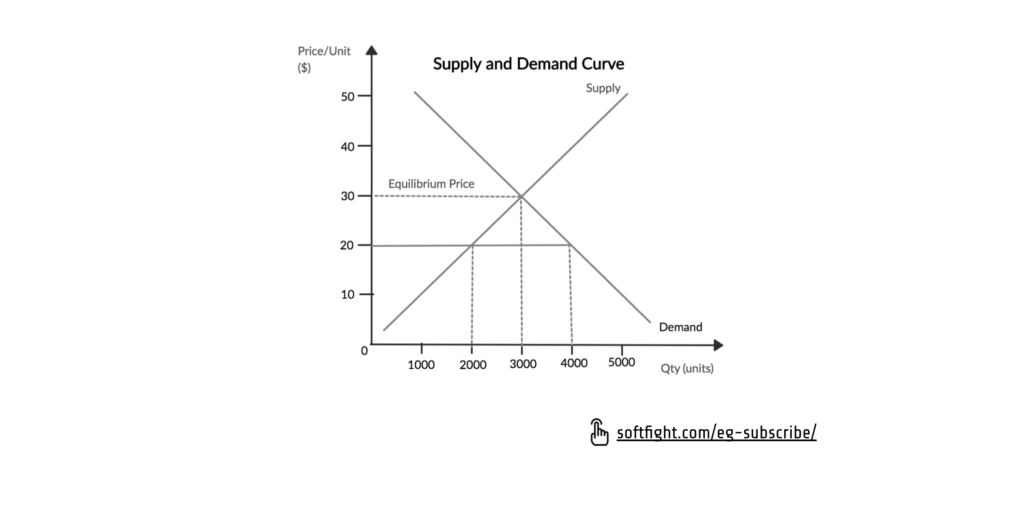

Every market, in every geography, at a particular moment in time, has a certain relationship between price and demand. The ways in which the demand for a service from customers changes with changing prices is the price elasticity of demand for that service.

Some factors affect the price elasticity of demand:

- Availability of close substitutes

- Whether the services are a necessity or just a nice to have

- Psychological factors relating to the decision makers previous experience, expectations and perceptions as to what is a fair price

- The proportion from the total budget spent on those services

- Time elapsed since the last change in price

Can anything be done?

Looking at the list above, it might seem that you cannot do much.

It looks as if the factors affecting price elasticity are out of your control.

They are, in the aggregate.

If we measure it for the entire market of companies buying software development services, there is not much you can do as a single supplier to change the market.

But there are a lot of things you can do in your corner of the market.

First, even in industries with elastic demand, where the volume changes significantly with changing prices, there are some types of customers that have inelastic demand, where they continue to buy even if the prices increase a lot.

Your first job is to find those types and customers and create an offer that is appealing to them.

Your second job is to communicate and document the value you create for your customers, so that their price sensitivity (which is the qualitative factor that leads to price elasticity in the aggregate) is less important in their decision making.

WHAT THIS MEANS FOR YOU

The simplest way to use price elasticity and price sensitivity to your advantage is what I call “auctioning your own price”.

Update your sales process so that for any project proposal that you send to a customer you introduce one more step, immediately after the price has been calculated.

Take 2 pieces of paper and put them in front of you (or 2 application windows on the screen):

- On one of them write everything you know about the client and the competition on the project. (Customer A and competitors M and N).

- On the other one, write your price. Let’s say it’s 100.

Then ask yourself these questions:

- If I am confident that customer A will choose us over the competition at price 100, will they still choose us at 105? If the answer is yes, strike 100 and write 105.

- If customer A will choose us at 105, will they still choose us at 110? If yes, strike 105 and write 110.

- What about 114?

- 116?

- Based on what we know about competitors M and N, what is the probability that they will offer a much better price-value combination?

- 118?

- What is more important for customer A: unit price or total budget?

- 119?

- 120?

Stop when the answer is no.